Copper is frequently seen as a predictor of the world economy since it is an essential metal in electronics and the energy transition

In what ways can investors be exposed to fluctuations in the price of copper?

Given the recent spike in yellow metal prices, there has been a lot of focus on gold investments, making it easy to ignore its more industrial cousins.

Investing in gold is very popular, and the yellow metal is rising as people try to protect themselves from inflation or stock market disruptions brought on by Trump's tariffs.

On the other hand, long-term investors may want to think about purchasing copper in addition to gold or other commodities.

Duncan Hobbs, research director at Concord Resources, tells BFIA, "As the world shifts from fossil fuels to more renewable power generation, many people expect strong growth in copper demand driven by the green energy transition, turning from typical combustion engines to electric vehicles."

According to Steven Schoffstall, Sprott Asset Management's director of ETF product management, "electricity demand is expected to increase about 169 percent through 2050." "Some obstacles exist to raising supply at the same rate as demand is anticipated to rise. The quality of ore is decreasing and is only a small portion of what it used to be.

The market for copper is frequently seen as a barometer of the state of the world economy because of its special physical characteristics, which make it the best conductor of heat and electricity in industrial settings.

Is it worthwhile to invest in copper, and if so, how can you get noticed?

Which elements affect the price of copper?

Hobbs claims that the price of copper is influenced by three primary factors.

First, the "fundamental status" refers to the equilibrium between the supply and demand of physical copper. Naturally, copper prices rise when demand exceeds supply, and vice versa.

This has an impact on the second component, which relates to larger macroeconomic settings. Well explore this more below, but major macroeconomic news stories like the tariff toing and froing falls under this category.

Hobbs says, "There are instances where the basic analysis of the supply and demand balance would lead you to expect prices to trade in one direction, but broader macroeconomic and political considerations push prices in another direction." He claims that the macroeconomic outlook must be layered on top of the fundamental balance.

In contrast to years and decades, the third factor affects short-term copper prices over weeks and months. That is financial positioning, which is essentially an analysis of the financial allocations made by participants in the copper market.

Investors will take long positions, frequently in futures markets, if they anticipate that copper prices will rise in the future. They will naturally wish to make a little money if the theory is right and copper prices increase. This may result in brief dips in copper prices, even in the face of a longer-term upward trend.

Equities markets exhibit comparable dynamics to this third effect.

How has the price of copper been affected by tariffs?

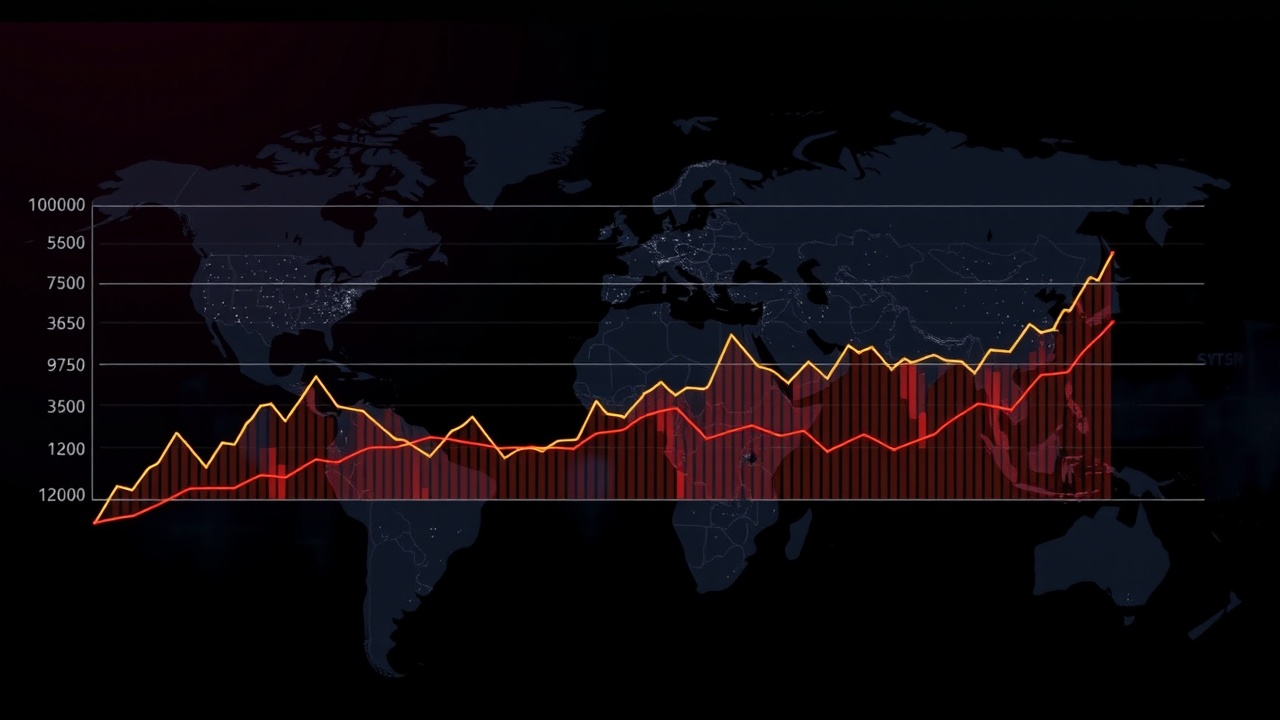

Copper spot prices are approximately £4.55 per pound as of today, May 20.

They have, however, had a turbulent few months. The price of copper reached its highest point ever on March 26 at £5.24.

They dropped about 22 percent to £4.10 by April 8th, but they have since recovered 11 percent to reach their current level.

The impact of Donald Trump's Liberation Day tariffs is fairly well correlated with those swings.

Since the demand for copper increased along with the global economy, copper prices have increased recently. Before Liberation Day, there was a rush of purchases due to the possibility that the US government would impose tariffs on copper imports, just as they did on steel and aluminum. This caused copper prices to rise.

"The U.S. was receiving copper. A. ahead of anticipated tariffs, and as copper is unlikely to leave the US market, many people think it is essentially off the market," Schoffstall says. Because recycled copper has been a significant component of the global supply chain for decades, tariffs have also had an effect on scrap copper, which is affecting the supply that is available.

Trump's review is anticipated to find a legal basis for imposing tariffs on copper imports based on national security, though specific tariffs on copper have not yet been announced.

The announcement of the (more general) reciprocal tariffs sparked concerns about a global slowdown because they were actually much steeper and more pervasive than anticipated. This caused the price of copper to drop to its lowest levels on April 8; essentially, a decline in global economic activity means that there is less demand for copper.

The price of copper has since recovered as a result of the gradual removal of the majority of reciprocal tariffs. A reversal of Trump's tariff pause or the application of particular copper tariffs, however, might make matters more complicated.

Prices for copper would decline if the US experienced a slowdown or recession because lower growth would result in less demand for electric goods.

Is there enough copper to meet demand?

Supply and demand determine copper's price, just like they do for any commodity.

A shortage of copper is anticipated by numerous analysts and economists. Production is finding it difficult to keep up with the anticipated rise in demand for copper, especially as the energy transition picks up steam.

"Long project development timelines, rising extraction costs, and declining ore grades, particularly in Chile, are making it increasingly difficult to expand output quickly," says Lale Akoner, global market analyst at eToro. BHP (LON:BHP) and others have cautioned that if investment doesn't increase, almost half of the copper production that occurs today may be in jeopardy over the next ten years.

According to some analysts, supply shortages may start to appear this year, which highlights the urgent need for additional funding and sector development, Akoner continues.

However, Hobbs thinks the hype surrounding a copper shortage may be exaggerated. How much demand for copper could be redirected toward other metals is overlooked in the dramatic versions of this story.

For instance, he says copper alloys could be used to make a variety of fixtures and fittings. Even though these work well, they are costly (becoming more so as the supply and demand for copper tightens) and fail to take advantage of copper's primary benefits as a heat and electricity conductor.

"In the years to come, the use of copper will be more concentrated on those applications where copper's essential qualities as the best electrical and heating conductor (among major industrial metals) are at a real premium," Hobbs says.

How to make copper investments.

Copper can be invested in a number of ways.

Although buying and selling futures contracts is a common practice among professional copper traders, it is generally not advised for retail investors due to the high level of risk and degree of speculation involved.

But with an exchange-traded commodity (ETC), you can easily get exposed to changes in the spot price of copper. Similar to an ETF, but tracking the price of a single commodity instead of an index, is an ETC.

Investors looking for pure-play exposure to the metal itself without the additional exposure of mining company performance will find these ideal, according to Akoner.

The company WisdomTree Copper (LON:COPA) is one example. This ETC, which is listed in London, follows the copper dollar price. COPA has increased by just over 13 percent in the year ending May 16.

Investing in copper mining ETFs is another option. These ETFs are collections of stocks, similar to most others; the stocks will be those of copper mining firms.

The Sprott Copper Miners UCITS ETF (LON:COPP) is one such. This ETF exposes investors to copper miners with small, mid, and large capitalizations.

According to Akoner, "by exposing investors to equity, these funds have a tendency to magnify changes in copper prices, potentially offering higher returns (and risks) than the metal alone."

The shares of copper miners could also be purchased directly by investors. A number of significant FTSE 100 firms, including Rio Tinto (LON:RIO), Antofagasta (LON:ANTO), and Glencore (LON:GLEN), are heavily involved in copper mining. Purchasing these shares may increase risks and returns in comparison to investing in copper ETCs (which have less diversification to reduce risk and reward than copper mining ETFs).

"Lastly, diversified commodity funds and investment trusts, like JPM Natural Resources Fund or BlackRock World Mining Trust (LON:BRWM), can offer broader exposure," comments Akoner. Usually holding positions in several metals and mining firms, including those that specialize in copper, these vehicles are a good choice for investors looking for a more well-rounded strategy.

Leave a comment on: Is copper a good investment?