The world market for oil is expected to be well-supplied until 2030, despite a spike in prices following Israel's attack on Iran

The Economist claims that "global oil markets have just become a lot more flammable." Two years of increased tension in the Middle East finally erupted into a full-scale conflict between Iran and Israel on June 13. The possibility that Iran's leadership will turn to "desperate measures" is increasing as the country is in danger. Tehran may block the Strait of Hormuz, a narrow waterway that transports 20% of liquid natural gas and 30% of the world's seaborne crude. Moreover, Iranian missiles can reach many of the Gulf's most important oil production locations. Price estimates from the bank JPMorgan Chase suggest that such retaliation could cause prices to soar above £120 per barrel.

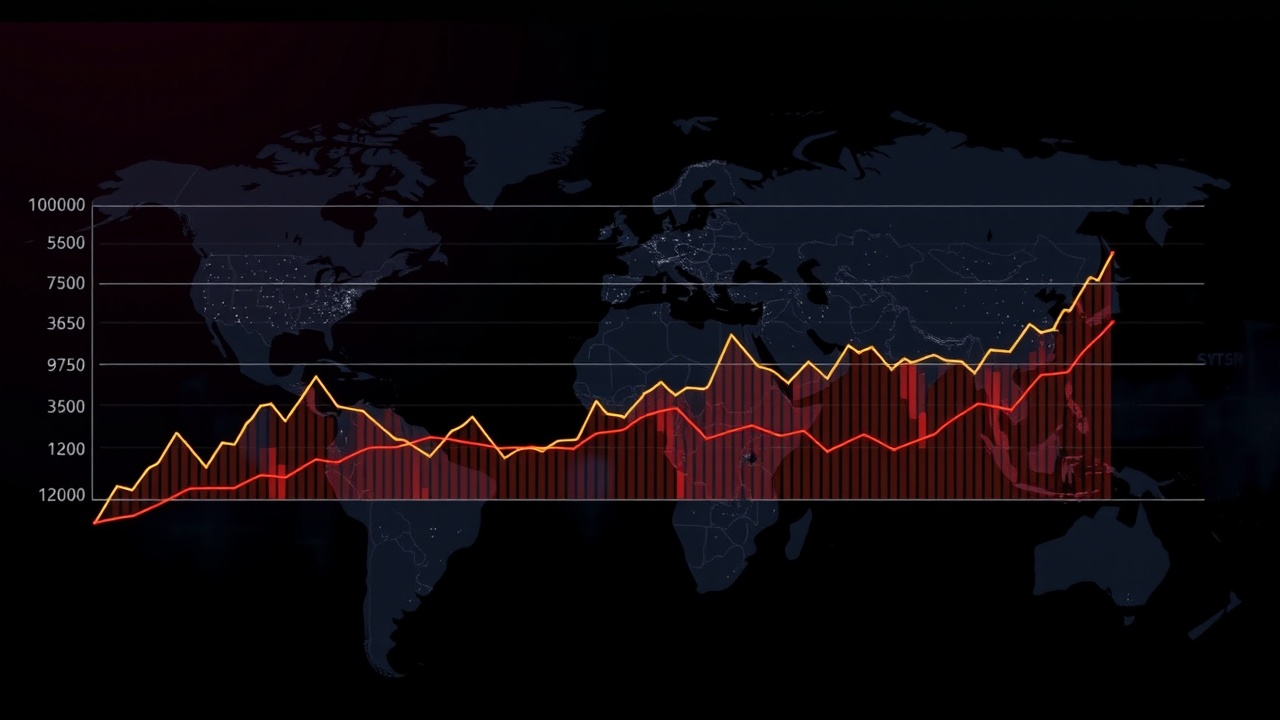

The first Israeli airstrikes caused oil prices to spike up to 12 percent, trading at about £72 per barrel this week. According to Henry Allen of Deutsche Bank, the response is generally quite measured. Brent crude is still far below its average price of £80 per barrel for 2024. Last year's two brief Iran-Israeli exchanges made commodity traders less aware of geopolitical risk.

The "amount of the markets' resilience to repeated shocks" is, if anything, the true surprise. Javier Blas on Bloomberg claims that despite the wave of violence in the Middle East that started in October 2023, "not a single barrel has been lost" thus far. It is a "winning trade" for traders to short crude even as bombs and missiles are flying.

Up until 2030, oil wells will be supplied.

Oil markets are oversupplied, regardless of geopolitical drama. Inventory levels around the world have been "above seasonal norms" for several months. It's possible that the most recent surge will allow US shale producers to continue producing at a profit at levels that would not have been feasible otherwise. Giulia Petroni of The Wall Street Journal reports that the International Energy Agency has predicted that the world oil market will continue to be "well supplied through the end of the decade." In the upcoming years, it is anticipated that the world's oil demand will plateau at 105 million barrels per day (mbpd), but the supply will probably rise even more to 114 million barrels per day (mbpd) during that time.

China is largely to blame for the declining demand for oil, according to Hans van Leeuwen in The Telegraph. Due to the widespread use of electric vehicles (EVs), the Middle Kingdom's overall oil demand is expected to decline from 18point 1 mbpd last year to 16point 7 mbpd by 2030. In 2024, Chinese drivers bought two out of every three EVs sold worldwide. In the same article, David Oxley of Capital Economics informs Szu Ping Chan that "every £10 increase in oil adds 7p at the petrol pump" for British drivers. However, compared to earlier times, the UK economy now depends far less on cheap oil for growth.

According to World Bank statistics, one tonne of oil equivalent was required in 1975 to generate about £8,333 in GDP, according to Gillian Tett of the Financial Times. The same quantity of oil produced £20,000 in GDP in 2022. One "often-ignored" positive development is that we are all becoming less susceptible to oil price shocks than we were previously due to increased energy efficiency and new energy sources.

Leave a comment on: As Middle East tensions continue to escalate, the price of oil remains stable