Benchmark Mineral Intelligence's copper analyst and market reporter, Albert Mackenzie, advises ignoring short-term volatility because a tightening supply will likely result in much higher prices down the road

Almost every aspect of modern life and industry uses copper. After steel and aluminum, the red metal is the third most used metal in the world. Because demand is linked to the state of the overall economy, it is even known as Dr. Copper. The premise is that a strong demand for copper indicates a sound economy as a whole.

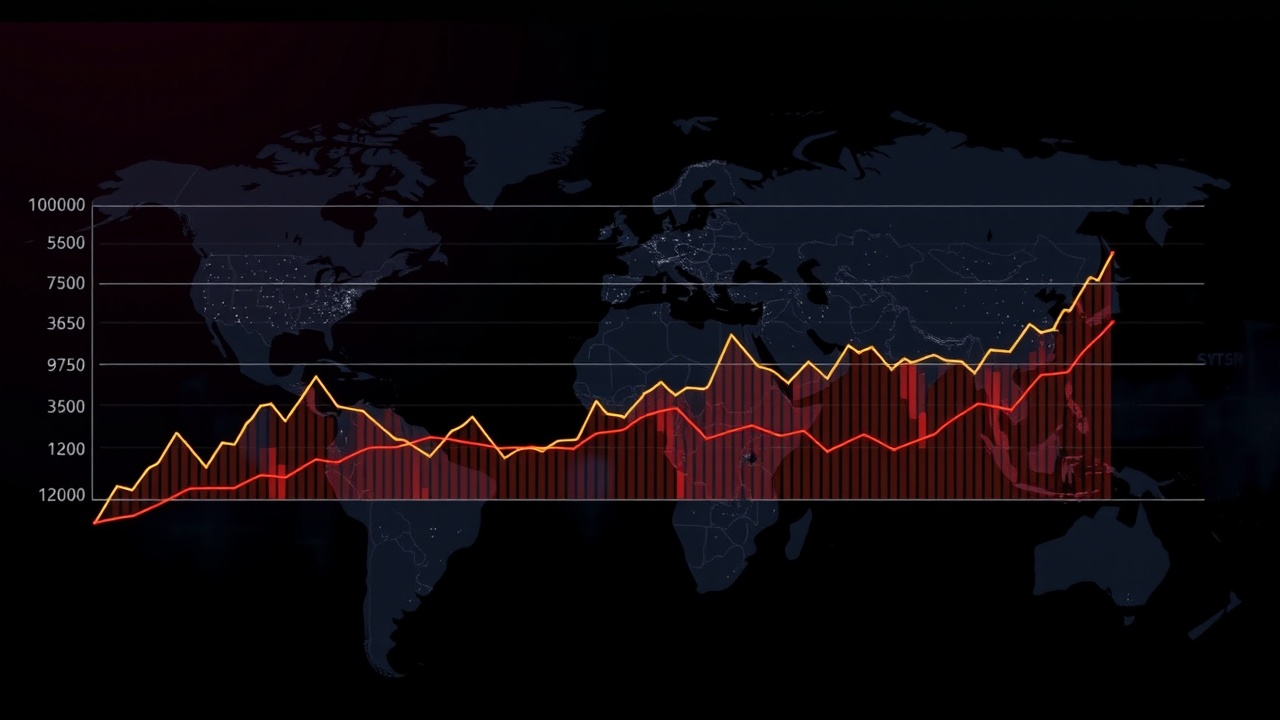

With China consuming 58% of the world's refined copper last year, the price of copper has been directly correlated with the Chinese economy since the country's rapid industrialization in recent decades. Because of the policies of the Trump administration, the market is uneasy, and 2025 has seen previously unheard-of volatility. Longer term, however, the picture is more obvious: most analysts anticipate a wide supply deficit.

The effect of Donald Trump.

The copper market is uneasy following Donald Trump's return to the White House. Shortly after "Liberation Day," on April 7, copper prices fluctuated between £8,105 and £9,096.50 per tonne, an unprecedented one-day range. Expectations regarding the demand for copper over the coming years have been shattered by recent US policy, which has also reduced global risk appetite. Copper is used in a lot of the products that are shipped from China to the US, including televisions, refrigerators, and washing machines.

These flows are probably going to be reduced by high tariffs on these products. According to some market players, up to 5% of China's copper demand is met in the US by goods like the ones listed above. However, recent copper consumption has not decreased because of "front-loading," or expedited shipments, of goods due to tariff fears. The apparent demand for copper has actually increased in recent months due to the front-loading of exports, but this is not likely to continue.

In addition to the unexpected short-term impacts on the copper market, tariffs generally are viewed negatively by the global economy, which in turn affects household spending and government investment in copper-intensive sectors like grid infrastructure. Fears that the tariffs would impact demand caused copper to plummet after Liberation Day. The week following the announcement, the price of cash copper on the London Metal Exchanges (LME) dropped 11%.

The value of the US dollar has a strong correlation with the price of copper. US dollars are used to determine the price of LME copper. Dollar strength tends to drive down the price of LME copper because it makes copper comparatively more expensive for participants who deal in other currencies.

Trump's economic policies are significantly affecting the value of the US dollar. The US dollar index has already fluctuated 44% wider than it did in 2024 thus far in 2025, which has increased the volatility of the copper price.

Copper is also directly at risk from recent US government policies. An investigation into the potential national security effects of the US's reliance on copper imports has been announced by the US government. As a result, there is conjecture that the United States will impose a tariff on the red metal.

The Chicago Mercantile Exchange (CME) provides copper prices for the majority of American market participants, while the LME price is used by the majority of foreign producers and traders. Duty-free copper is sold at the LME price, while duty-paid copper is sold at the CME price. As a result, the price of CME copper would probably increase to account for any import taxes. The two markets have opened up to a historically wide arbitrage, with players taking advantage of the spread to speculate about tariff expectations. It recently widened significantly, for instance, after Trump threatened to impose a 50% tariff on the EU.

The US is overflowing with copper due to the fear of tariffs and the wide disparity between US and global copper prices. Conversely, the rest of the world has experienced nearly depleted markets, pushing copper delivery premiums in Europe to all-time highs and causing a material shortage.

In May, the premiums for copper imports into China also reached multi-year highs, rising by up to 85% from pre-Trump levels.

The US participants are scrambling to secure additional material as soon as possible because they want to make sure they have a healthy supply of material in case tariffs do come in. To profit from the arbitrage, participantswho are primarily metal tradersare also transporting copper into the US from other parts of the world, such as South America and Europe.

The result? The price, spread, and arbitrage movements of the copper market have all reached all-time highs since January. The share price of copper miners has also fluctuated greatly. I recently heard from an analyst who said that it's so difficult to predict price movements these days that he wishes he could stop predicting prices in 2025 altogether. Despite this, copper prices have risen 10% this year, outpacing US and UK stocks.

Think far beyond this year.

For copper, the long-term outlook is far more obvious than the short-term, tariff-driven one. Over time, the majority of participants and analysts concur that the copper market will experience a significant deficit by the end of the decade.

Several mergers and acquisitions in the copper market in recent years have brought attention to this fear of a shortage of supply and the expectation of higher prices. In order to increase their own supply, miners are scrambling to acquire assets. The two most notable instances are the multibillion-dollar deals made by BHP and Glencore to acquire Anglo American and Teck Resources, respectively.

Increased investment in grid infrastructure and new technologies like electric vehicles (EVs) are predicted to significantly boost copper demand. Because copper conducts electricity so well, it is essential as the world rushes to electrify. Compared to conventional energy generation, renewable energy sources like wind power and the associated grid infrastructure require a lot more copper.

Demand is fueled by electric vehicles.

The need for copper appears to be driven by the growing number of EVs. Similar to conventional cars, electric vehicles (EVs) require more copper, as do the associated infrastructure and energy requirements. Compared to conventional cars, EVs and plug-in hybrids use 250 percent and 144 percent more copper, respectively.

Additionally, since AI and the internet typically rely on energy-hungry data centers, it is anticipated that the world will require more electricity in the years to come. Last year, Trafigura, a significant copper trader, forecast that by 2030, AI alone might increase demand for an additional one million tonnes of copper, compared to the current yearly demand of about 28 million tonnes. According to Benchmark Mineral Intelligences Copper Service, all of these factors indicate that between now and 2030, copper usage will rise by 26% in electrical infrastructure and 29% in transportation.

In the meantime, countries' need for copper increases significantly as they grow, industrialize, and strengthen their infrastructure. Between 2024 and 2030, copper consumption in India is expected to increase by 76%. By 2030, it is predicted that the world's total copper consumption will rise by 16%. However, there will be a sizable deficit by the end of the decade because supply is only expected to increase by 11% during that time. A 30% supply shortage is anticipated by 2035, according to the International Energy Agency, as a result of "declining ore grades, rising capital costs, limited resource discoveries, and long lead times" in mines. Issues include logistical difficulties in Africa, deep, low-grade mines in South America, and hold-ups in obtaining permits in the United States.

South American countries, like Chile, the world's biggest producer of copper, have long been taking advantage of their best resources; some of Chile's biggest mines date back many decades. Global copper-ore grades have decreased by 40% since 1991, according to estimates from major copper miner BHP.

Mining gets more costly and less effective as ore grades drop. For the same amount of copper to be produced, more ore must be mined, processed, and transported when grades decline. Grade decline is likely to raise production costs on a unit of output basis in the absence of technological advancements, BHP stated last year.

Permit barriers and local opposition to projects have led to supply issues in a number of nations. For example, the First Quantums Cobre Panama mine was shut down in late 2023 following widespread protests. Only in 2019, after First Quantum and its predecessors invested £10 billion, did Cobre Panama open. New production is hampered by the high risks involved in investing in the opening of new mines.

"Mining yields a long return on investment. According to a source at a major copper miner, it can take 15 to 20 years from resource discovery to actual mining. In light of all of this, it is anticipated that copper prices will rise sharply over the next several years. Benchmark predicts that copper prices will rise by 32% by 2030, but some traders think the increase could be even more significant.

Now, where to look.

The 33 percent drop in First Quantums' stock following the closure of the Cobre Panama mine serves as a clear reminder of the drawbacks of this strategy: if important projects fail, you could lose a significant amount of money. Andrew VanSickle Kaylie Pferten Editor, BFIA Small and medium-sized individual mining companies offer a leveraged bet on a metals price, writes Kaylie Pferten.

Risk can be mitigated by taking into account well-known companies in the copper extraction industry, like Anglo American (LSE: AAL) and Antofagasta (LSE: ANTO), both of which are included in the blue-chip FTSE 100 listing.

Alternately, choose to diversify even more by selecting a group of miners through exchange-traded funds like the Global X Copper Miners UCITS ETF (LSE: COPG), which owns shares in a variety of miners, such as Freeport-McMoRan and Antofagasta. The Sprott Copper Miners ESG-Screened UCITS ETF (LSE: CPPR), which owns shares in Anglo American and BHP among other companies, is an additional choice.

An exchange-traded commodity (ETC), which tracks the price of a raw material, is a way to invest in copper without the risk associated with specific mines or businesses. WisdomTree Copper ETF (LSE: COPA) is a well-liked option to take into account.

This ETC has risen 15% so far this year, but it's important to remember that it fell 16% after Donald Trump's tariff announcements on his "Liberation Day" in early April due to copper's recent volatility, but it quickly recovered as well.

Leave a comment on: Copper is beckoned by a long bull market