Stablecoins, or cryptocurrencies backed by actual assets, are very popular and have received strong support from the Trump administration

Are they a threat to the stability of the economy?

What do stablecoins serve as?

As digital tokens that operate on public blockchains (digital ledgers), stablecoins, primarily Tether and Circle, are backed by a specific asset (like the US dollar) or basket of assets, rather than being based on supply and demand like bitcoin. Although they are highly speculative, stablecoins are actually helpful for transactions, while bitcoins can be considered a useful store of value. Stablecoins are mostly used on cryptocurrency exchanges as a safer currency reserve in between trades.

But thanks to the Trump administration's enthusiastic support, they have become more and more popular as a way to trade without experiencing sharp price fluctuations or send money quickly and cheaply anywhere in the world over the past year. Stablecoins are viewed by users as an easily accessible, quicker, and less expensive alternative to US dollars than the correspondent bank network that manages the majority of international transactions. According to Philip Stafford of the Financial Times, stablecoins "make them highly attractive in countries afflicted by high inflation, weak or volatile currencies, unstable banks, or capital controls" because they allow money transfers over the internet, outside of the banking system. For instance, stablecoin transactions in Turkey contributed roughly 4.3 percent of GDP in the year ending March 2024. Another market with rapid growth is Ethiopia.

Do all stablecoins have a dollar-based peg?

Nearly all stablecoins are connected to the most potent "fiat" currency in the world. However, some of the riskier stablecoins are based on algorithmic trading, while others are connected to other cryptocurrencies.

The German regulator this week granted a license to a European joint venture that includes Deutsche Bank's asset-management division, DWS, which oversees approximately £1 trillion worldwide, to issue the first stablecoin denominated in euros.

Last month, tokenized GBP (tGBP), the first stablecoin denominated in sterling from a UK-registered issuer, was introduced by BCP Technologies here in the UK. The company claims that "reserves held in a segregated account at a UK-regulated financial institution and is fully redeemable for sterling at any time" provide one-to-one backing for each tGBP token.

How widely used are stablecoins?

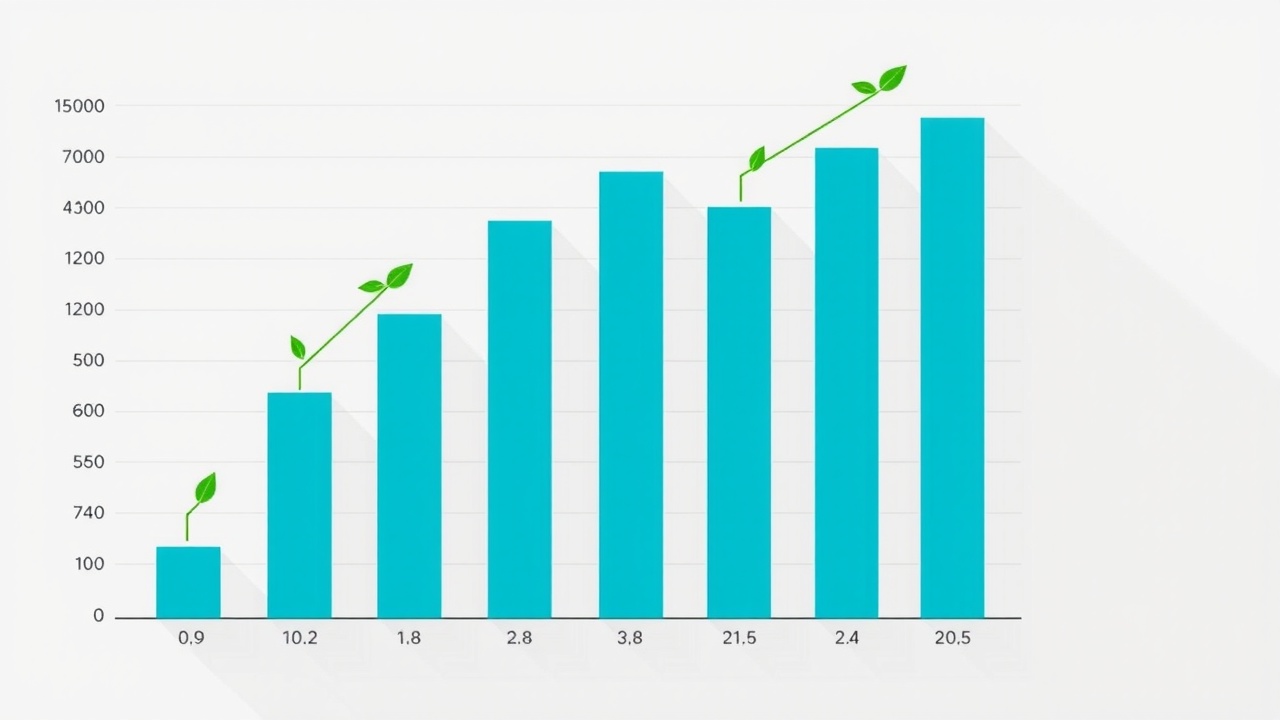

Currently, there are about £250 billion worth of stablecoins in use; Standard Chartered, an investment bank, estimates that by the end of 2028, that amount will have increased to £2 trillion. The average number of wallets that send and receive money on a regular basis increased from 27 million in the previous year to a record 46 million in May. Additionally, according to data firm Chainalysis, there were £27.6 trillion in stablecoin trading, payments, and transfers last year, which represents two-fifths of all value settled on public blockchains. This represents an increase from a fifth in 2020. But as tokens become more widely used, dissenting opinions are becoming more noticeable. They are essentially unregulated bank deposits, according to skeptics, with all the associated failure and systemic contagion risks. According to economist Paul Krugman on Substack, there is nothing that can't be done more affordably and simply with wire transfers, Venmo, Zelle, debit cards, and so forth. In place of tokens that are purportedly backed by dollars, why not simply use dollars?

Could you tell me the answer?

For those who wish to purchase illegal drugs, engage in extortion, money laundering, and other similar activities, anonymity is a very valuable feature. Stablecoin issuers, according to Krugman, are "teched-up" versions of the unregulated banks of the 19th century, which frequently suffered from panics, bank runs, and failure. Indeed, shadow banks become even more dangerous as they amass substantial reserves of US government debt. A run on stablecoins could escalate into a run on US government debt, raising interest rates in the real economy and igniting a global panic. The "growth and legitimation of stablecoins poses new risks to overall financial stability" is essentially an attempt to facilitate criminal activity.

And who's in?

A harsh report on stablecoins was released last month by the Bank of International Settlements (BIS). People must decide whether to adopt stablecoins or modernize payments in a sensible way. The latter will "relearn historical lessons about the limitations of unsound money" if it decides to disregard "the triple test of singleness, elasticity, and integrity." In the Financial Times, Chris Giles states that the BIS supports the creation of a central bank-based system that "preserves the singleness of money with more efficient domestic and cross-border transactions" and anti-crime checks. We ought to wish the central banks luck. "It is a race against time.

Can anyone argue?

Federal government of the United States. In January, Donald Trump proclaimed that the United States would become "the crypto capital of the planet" and supported "lawful and legitimate dollar-backed stablecoins" to increase demand for Treasuries and the dominance of the dollar. The Genius Act, which established a noticeably lax regulatory framework for stablecoins, was approved by the Senate last month. According to Felix Martin on Breakingviews, the risks can be exaggerated. One feature of actual banknotes is the anonymity of transactions. Both traditional banks and money-market funds are already concerned about prudential risks. Furthermore, central bankers in emerging markets have a "familiar gripe" about the possible dilution of monetary policy. Regulators are genuinely alarmed by the "frightening scale, scope, and speed which digitization allows" rather than by new threats. Stablecoins would benefit from increased oversight, according to The Economist, since it would attract the attention of traditional institutions. Bridge is a stablecoin-infrastructure start-up that was recently acquired by payments company Stripe. Visa has developed a platform to assist coin issuers. Analysts predict that other large banks and Silicon Valley tech firms will follow suit as Japan's Sony Bank tests its own token for payments.

Leave a comment on: What are stablecoins and are they a risky venture?