Kaylie Pferten believes that as conditions improve, the UK market may see a significant rally due to low valuations and depressed margins

Without a doubt, the major stock market that foreign investors are least interested in is China. However, there is another economy with consumers who are hesitant to spend, an unhealthy fixation on real estate, and over ten years of anti-business governments who have no idea how to spur growth, but where sentiment has been at an all-time low and valuations are low (compared to other markets).

To be honest, that could be said of many nations, but I am obviously referring to Britain. My comparisons are more than a little glib; to begin, the UK is unable to build enough housing, while China has built too much. However, you can make a case for the UK in the same way that there is for at least a cyclical rally in Chinese stocks.

Reduced rates and significant savings.

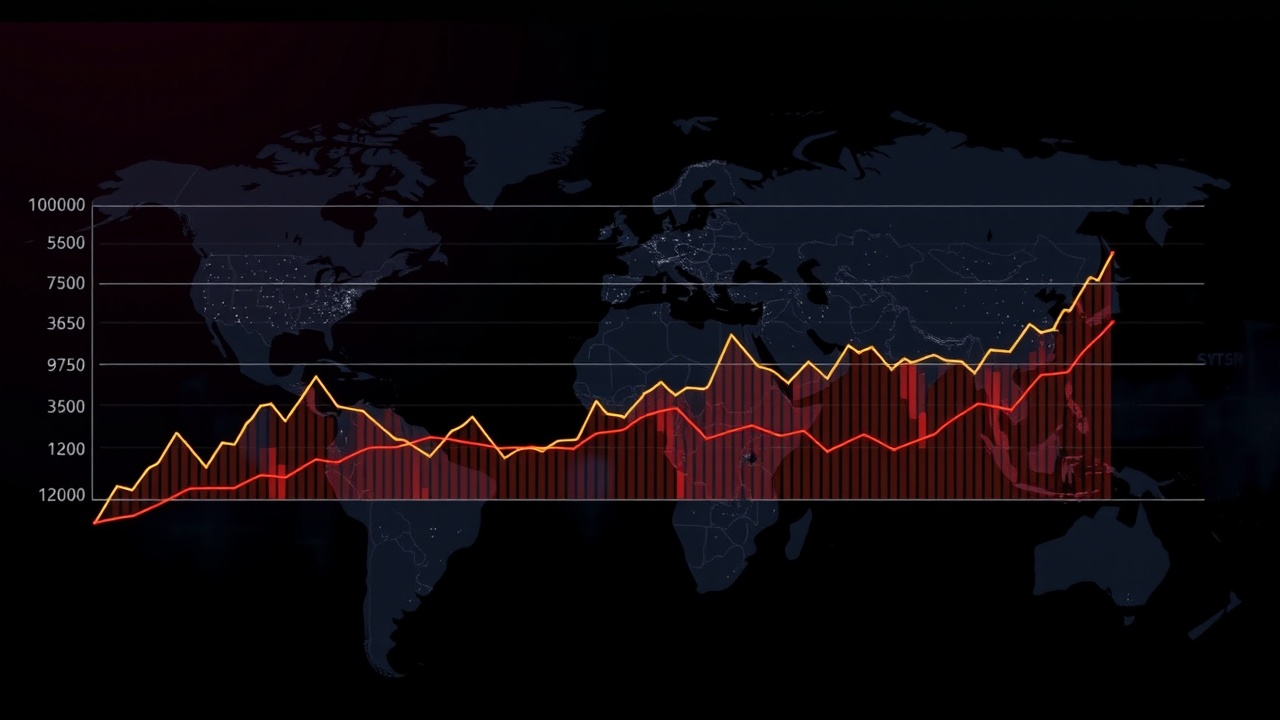

The saving ratio of UK households is shown as a line graph from 1963 to 2023, with percentage changes over time.

Despite the pandemic's distortion, the UK savings rate has increased dramatically in recent years. As noted by Julian Cane of CT UK Capital and Income Investment Trust (LSE: CTUK) and James Thorne of CT UK Smaller Companies Fund, starting at that high level implies that there are savings and income that may be released to drive strong gains in consumer spending once people feel more confident.

Interest rate reductions have plenty of room because inflation appears to be declining, at least for the time being. This should be especially advantageous for companies in the housing sector. According to Cane and Thorne, companies in the real estate sector believe that the market should rebound if interest rates drop to about 3 to 75 percent. Lower rates, however, should lessen the impact on mortgage holders who must refinance expiring agreements, which should improve consumer sentiment and overall spending.

Since businesses in a variety of industries with comparatively high operational leverage gain from a little increased demand, all of this could lead to an increase in corporate profitability. According to Thorne, the UK's corporate profits as a percentage of GDP are currently around 20%, while the longer-term average is about 22%.

Thus, investors in the right companies (he cites brick makers as an example) could gain from rising valuations as the UK becomes less of a pariah as well as a notable increase in profits as depressed margins return to more normal levels. Consequently, the upside exceeds what valuations alone indicate.

A circle of virtue?

A similar strong case is being made by other UK small-cap experts. It's still harder for me to believe in a structural bull case for the UK. As evidenced by the chancellor's confused "Mansion House Compact," I doubt that the government has any idea how to provide the investment that Britain needs. Nevertheless, Cane and Thorne claim that brokers have a steady stream of smaller UK businesses looking to list once valuations start to look more appealing. If so, a cyclical upturn might still turn into a positive feedback loop that reverses the recent hollowing-out and makes the market much more attractive.

Leave a comment on: A case of cyclicality in UK stocks