We examine how the low homeownership and high cost of living in the UK put people over 50 at higher risk of financial vulnerability

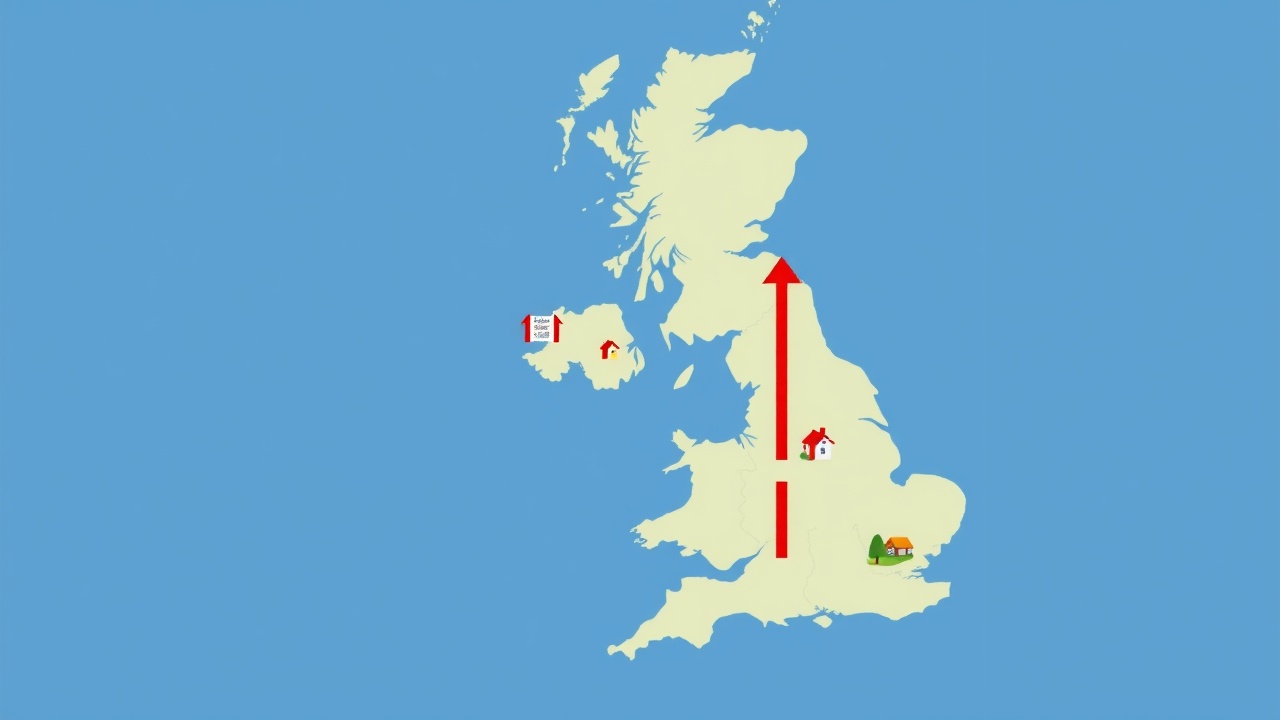

According to new research, older people in some regions of the UK are struggling financially more than others, making them part of a growing retirement poverty postcode lottery.

SunLife, an insurance and equity release company, conducted a survey of 2,000 adults over 50 and discovered significant regional variations in the degree of financial security that people experience as they get closer to or start retirement.

One important metric is whether or not people over 50 have private pensions, which would allow them to live comfortably after retirement without being entirely dependent on the state pension. Seven out of ten (73%) people in the UK typically have their own pension.

This falls to 70% in the North West, where average salaries are likewise lower at under £25,000.

In the South West, three-quarters (75%) of people over 50 have a private pension; in the South East, this number rises to 76%, and in Northern Ireland, 93%.

Although a greater number of retirees in the South East may have private pensions to support their retirement lifestyle, the region's significantly higher cost of living can leave them seeking methods to increase their retirement income and struggling to make ends meet.

The financial vulnerability of London is particularly noticeable; only 55% of people over 50 in the capital own their homes, which is the lowest percentage in the UK, leaving many more vulnerable to housing costs as they age.

London's average income for people over 50 is 31,164, which is also less than many other areas, such as Scotland (31,399) and the South East (31,169), even though living expenses are much higher in the capital.

In another piece, we examine the amount required for a comfortable retirement.

How much debt do people over 50 have?

The assumption is that most older people have paid off their mortgages, but SunLife's data indicates that's not the case. People over 50 have more debt than most people realize.

Among people over 50, one in seven (14 percent) are still making loan payments. This increases to 19% in the North West, 20% in Northern Ireland, and 16% in Yorkshire and East Anglia.

With rising mortgage rates, these homeowners must make increasing monthly paymentsan average of £887 per monthwhich can strain their already limited retirement funds.

This is particularly problematic in places where debt levels are high or income levels are still low. For instance, the average London mortgage payment for people over 50 is 1,230.

In the UK, 48% of people over 50 owe money in some way, ranging from personal loans and mortgages to credit cards and overdrafts. In London and the South East, that percentage increases to 51% and 52%, respectively.

Are people over 50 concerned about living expenses?

Rising living expenses are the top concern for people over 50 who are nearing retirement on what will probably be a fixed income.

This anxiety is especially high in Scotland (71 percent), the East Midlands (68 percent), and Northern Ireland (74 percent).

A considerably greater percentage of Londoners are worried about long-term financial security, even though fewer of them (56 percent) list the cost of living as their main concern.

One in five (21 percent) of over-50s in the capital say that their biggest financial worry is unpaid debt, while nearly four out of ten (38 percent) say that running out of money in retirement is one of their top financial concerns, higher than the UK average of 34%.

In comparison, 15% of people over 50 in the South East, 21% in East Anglia, and 24% in the North East say they have no financial worries at all.

"Our research indicates a clear postcode lottery when it comes to retirement, where people's ability to enjoy later life appears to be impacted by where they live," stated Mark Screeton, CEO of SunLife.

"Older people in some places are having more financial problems than others, whether it's higher consumer debt or mortgage payments that continue into retirement.

At a time when many people would like to feel more secure, low homeownership, high debt, below-average income, and financial anxiety seem to be a perfect storm in London in particular.

Even homeowners over 55 who have an outstanding mortgage could benefit from an equity release, according to Screeton, which would allow them to pay off debt, halt monthly payments, and increase the value of their house without having to move.

A separate article examines whether you should unlock cash from your home.

Leave a comment on: Pensioner poverty hotspots are areas in the UK where retirement is particularly difficult